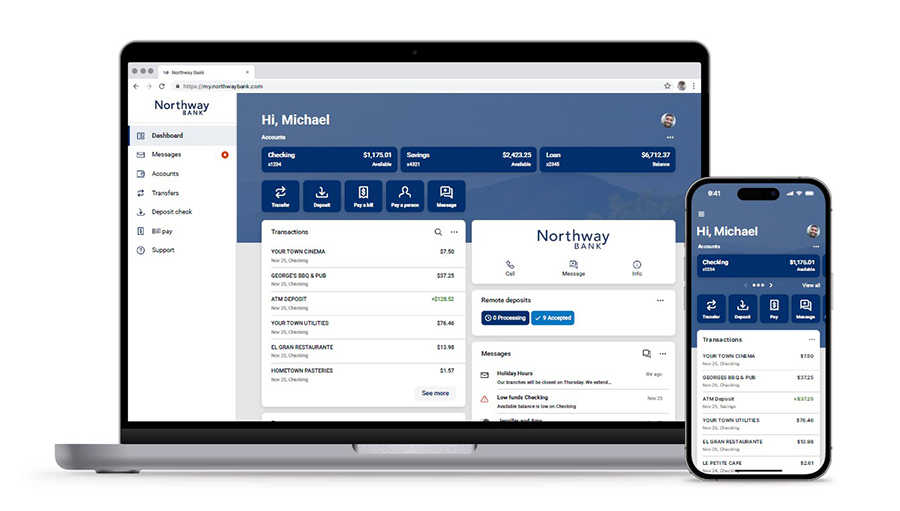

Do your banking whenever you like, wherever you are.

We are excited to announce our new Online Banking and Mobile Banking experience is now live!

With Northway Bank's Online Banking, you can take care of most transactions with just a few clicks and keystrokes. Pay bills, deposit checks, transfer funds, review statements, check balances, open accounts - all you need is internet access. Northway Bank's online banking technology is easy to use and highly secure.

Online Banking 24/7

Bill Pay

eStatements

Insights

Frequently Asked Questions

online Banking Benefits

- Your money wherever you need it - Our application works across your devices and is developed with industry-leading technology to deliver a smooth experience.

- Flexibility of being able to do your banking and pay bills wherever and whenever it's most convenient for you.

online banking Features

- No fee for personal online banking

- View balances and transactions - search for transactions, add a note or an image, and filter by tags. Understand your activity and find what you're looking for - fast.

- View deposit account statements and check images

- One-time or recurring transfers between accounts

- Make bank-to-bank transfers

- Make payments to your Northway Bank loan or line of credit

- Bill pay and person-to-person payments - pay bills or send money to friends and family quickly and securely (includes Amazon Alexa integration).

- Place a stop payment on a check

- Order checks or a new debit card

- Set email or text account alerts

- Activate, report a lost or stolen debit card, or suspend your debit card

- Customize your online banking dashboard to show what’s most important to you

- Download account balances and transaction history for upload into Quicken or QuickBooks

- Monitor and manage your finances with Insights

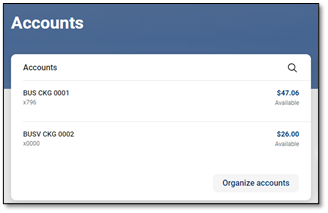

Adding Accounts to Online Banking

Adding or removing an available account from your Online Banking Dashboard:

- Click on the hamburger menu

- Click "Accounts"

- Choose an account from the list

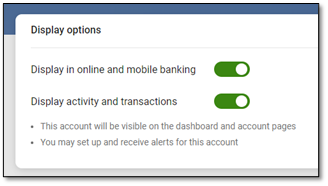

- Click "Settings"

- Use the Display Options toggle to add or remove an account from Online/Mobile Banking. Keep in mind, changes made within a browser, will transfer over into the mobile version, and vise versa.

Bill Pay Features

- Make a one-time payment

- Set up recurring payments

- Easily pay a friend, the babysitter, or just about anyone

- Integrates with Amazon Alexa for voice commands ("Alexa, pay my mortgage $850 on July 31.")

- Access bill pay history and payment records online

- View up to 36 months of bill pay history

- Set up payment reminders

- Select bill pay alerts that can be sent to you by email or text

- Download the Northway Bank mobile app and pay bills using the app

How to Enroll in Bill Pay

- Log into or enroll in online banking

- Click the Bill pay tab

- Follow the prompts to enroll

VOICE BILL pay for amazon Alexa devices

- Bill pay integrates with Amazon Alexa devices so you can use simple voice commands to securely and quickly:

- Complete bill payment activities

- Review scheduled payments

- Request basic information about payment history

- All you need to use this feature is a smartphone with the Alexa App installed, an Amazon account, and any Alexa-enabled device

- FIRST TIME USERS will need to go through a one-time setup process:

- Log-on to Online Banking, go to the Bill pay tab, select the My Account tab and go to the Voice bill pay section and create credentials for voice bill pay

- Log in to your Alexa account to access and enable iPay QuickPay in the Amazon Skill Store

- Enter the credentials and create a four-digit PIN

- Authorize the account link

- Acknowledge the related Alexa policies

- View our quick start guide (PDF 2.41 MB) for more detailed instructions

- To make a voice-enabled bill payment:

- Use Alexa to start the bill pay feature. Say, "Alexa, start iPay QuickPay."

- When prompted, provide your four-digit PIN

- Tell Alexa the company or person you'd like to pay, the payment amount and date

- Alexa will confirm your payment has been scheduled

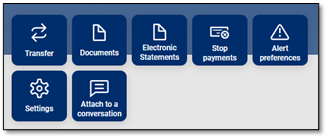

estatement Features

- Securely access account statements through Online Banking or Mobile Banking by navigating to the account and selecting "Electronic Statements"

- Print or save eStatements at home if you need a copy

- Reduce paper consumption and clutter

- View up to 7 years of statements

- Receive an email each month when your eStatement is ready

- No fee to go paperless and enroll in eStatements

How to Enroll in eStatements

- Log into or enroll in online banking

- Navigate to the account and select "Electronic Statements"

- Click "Sign Up/Changes" and select the accounts you wish to enroll

- Follow the prompts to complete enrollment

Insights

We know that the toughest thing about online financial management (OFM) is simply organizing all the details of your financial life.

And that’s why Insights is now built to make it much easier to understand your spending and gain insights about how your money comes and goes each month (including your non-Northway Bank accounts).

We’ve also improved Insights so it’s easier to use. That means you can focus on doing what you need to do, rather than organizing all the information on your own.

Insights from Northway Bank can help you stay on top of your bills, your cash flow and your entire financial picture, so you can set clear goals and achieve them.

Insights Features

Insights features:

- Simplified budgeting tools

- Easy to use interface

- See your upcoming bills and income in a clean, calendar view

- Mobile integration and iOS compatibility

- Auto-categorization of transactions

- Integration of your non-Northway Bank accounts for a full picture of your finances

- Email and text alerts

The tool is free,* but the insights are priceless.

Smarter Spending

On the Insights Overview tab, you'll see a snapshot of your cashflow, goal progress, monthly budget, and net worth. This gives you head start on breaking your spending into more specific categories.

Better Budgeting

Build and view spending targets that are important to your financial big picture. The new insights feature provides your spending history, along with suggestions for staying on track.

Add a Spending Target

Look at the budget insights for guidance on what to budget based on spending.

- Step 1: Navigate to Budgets

- Step 2: Click on the Spending Target you’d like to edit from the list.

- Step 3: Click “Edit Budget” to edit or delete.

- Step 4: You can change the name, amount, tags, and accounts associated with this Spending Target from here.

That’s it. It’s that simple.

Activate Insights

Quick Start

Welcome to Insights.

Overview

See a snapshot of your finances to include cashflow, goal progress, budget(s), and net worth.

Spending Targets

Users can look at the insights for guidance on what to budget based on spending.

- Step 1: Navigate to Budgets.

- Step 2: Click on the Spending Target you’d like to edit from the list.

- Step 3: Click “Edit Budget” to edit or delete.

- Step 4: You can change the name, amount, tags, and accounts associated with this Spending Target from here.

Cashflow

The cash flow calendar brings your budget to life through an interactive calendar.

- Step 1: Navigate to Cashflow.

- Step 2: Click the plus sign to “Add Income” or “Add Bill.”

- Step 3: Enter in the required information and select “Save.”

Goals

Create savings goals, like saving for a vacation, or a debt reduction goal, like paying off a high-rate credit card.

- Step 1: Navigate to Goals, and select “Add Goal.”

- Step 2: Select your desired pay off or savings goal.

- Step 3: Fill in the required information.

- Step 4: Click “Save” to complete the process of adding a new goal.

Keep in mind, your Goal Summary will update your completion date and the amount needed per month according to your preferences. Goals will automatically update your progress and will reflect your day-to-day account balances in PFM.

Add an Account

Syncing other accounts for a complete financial picture is simple.

- Step 1: Click the ellipsis and select "Link Account".

- Step 2: Review the information presented and click "Next".

- Step 3: Select an institution or search the name to find your external financial institution.

- Step 4: Follow the prompts to connect your external account

You’ll receive a notification on your PFM dashboard once the account has been synced successfully.

FAQs

Q: How do I sign up for Northway Bank's Online Banking?

A: You can enroll in Online Banking by going to our online banking enrollment page. You can also call our Customer Service Center at 800-442-6666, or stop by any of our branches. Our associates can get you set up online in no time.

A: You can enroll in Online Banking by going to our online banking enrollment page. You can also call our Customer Service Center at 800-442-6666, or stop by any of our branches. Our associates can get you set up online in no time.

Q: How do I log in to online banking?

A: At the top of each page in the northwaybank.com site, there is a login button for your convenience. Go to our secure login page.

A: At the top of each page in the northwaybank.com site, there is a login button for your convenience. Go to our secure login page.

Q: What will Northway Bank's Online Banking do for me?

A: Online Banking offers you another convenient way to access your Northway Bank accounts. Once you have successfully enrolled in Online Banking, you will be able to perform a variety of routine banking transactions online, including account inquiries, statement retrieval, transfers between accounts, and enroll in Bill Pay. You can also view images of your checks.

Q: What will I need to get started?

A: Any internet-enabled device, such as a personal computer, can interface with Northway Bank's Online Banking service. The security system also requires that you use a web browser capable of supporting 128-bit encryption.

A: Any internet-enabled device, such as a personal computer, can interface with Northway Bank's Online Banking service. The security system also requires that you use a web browser capable of supporting 128-bit encryption.

Q: Will I incur any costs for online banking?

A: No. Northway Bank customers will receive routine Online Banking services at no cost. Online Banking is offered for your convenience by Northway Bank.

Q: What accounts will be available through online banking?

A: When enrolling for Online Banking by visiting one of our branches or speaking with our Customer Support Center, you may designate which accounts you wish to access online. When enrolling via our online enrollment process, you will automatically have access to all of your accounts.

Q: Will I have 24-hour access to my accounts?

A: Yes. Online Banking will generally be available to you round-the-clock, every day of the year. However, there may be times when your ISP (Internet Service Provider) is experiencing down time, during which you will not have access to any internet services. Down time may also occur occasionally when we perform routine maintenance on our systems.

Q: How often is my account information updated?

A: Online Banking is updated continuously throughout each day.

Q: I am concerned about my privacy when using the internet. Should I be?

A: Absolutely, and so are we. Northway Bank is very serious about this issue and has developed an extensive policy to help protect you and your privacy.

Q: What measures have been taken by Northway Bank to ensure the security of my online banking transactions?

A: Information encoding, a password lockout system, and automatic log-off are just some of the methods used by Northway Bank to protect your Online Banking transactions. We recommend changing your Online Banking password frequently for an additional level of security. Northway Bank will never ask you for sensitive personal information in an unsolicited request to your email address. Should you receive any such requests, do not respond. Please report the incident to customer service by calling 800-442-6666.

Q: I have other questions regarding Northway Bank's online banking. How can I get answers?

A: For further information regarding Northway Bank's Online Banking, simply call the Customer Service Center at 800-442-6666, or stop into your local branch.

How to clear cookies

What are cookies?

Cookies are small packets of data sent to your browser from websites you visit that contain information about your activity on the page. Your browser saves this information in a small text file. Sometimes the cached data in cookies conflict with a website resulting in errors when you attempt to load the page. These cookies also take up room on your hard drive, even though they are very small files, if they are left untouched for a very long time.

To clear your cookies on Chrome, follow these steps:

- On your computer, open Chrome.

- At the top right, click the hamburger menu or ellipses.

- Click "Settings", then "Privacy and security", then "Delete browsing data".

- Next to "Cookies and other site data" and "Cached images and files," check the boxes.

- Click "Delete data".

Customer Service 800-442-6666

24-Hour Telephone Banking 888-568-6310

NMLS #405698