Northway Bank has designed accounts that offer the value and convenience you need to make running your business easier.

We can help you select the best product to help you run your business efficiently.

Business Value Checking

An economical account for businesses with low transaction volume.

Business Checking

A good choice for businesses with high transaction volume and a low balance.

Business Advantage

A good choice for businesses with high transaction volume and a high balance.

Business Advantage Premier

A good choice for businesses with especially high transaction volume and balances.

Compare Accounts

Which checking account is right for your business? Here's a handy chart to help you decide.

Business Value Checking

When your business needs a simple, straightforward account, this one delivers. Northway Bank offers the Business Value Checking account for lower transaction volume.

Contact your local branch or business banker.

Business Value Checking Features

- $100 minimum opening deposit

- No monthly service fee

- 100 items per statement cycle at no cost (items are defined as checks presented for payment, checks deposited, and per deposit); $0.50 per item thereafter

Business Value Checking Benefits

- Free Online Banking, Mobile Banking, and Bill Pay

- Northway Debit Card available at no charge

- Check access

- 24-Hour Telephone Banking

Business Checking

Business Checking is a non-interest-bearing account designed for larger clients with high transaction volume. An earnings credit allowance is applied against the monthly service fee and per item charges.

Contact your local branch or business banker.

Business Checking Features

- $100 minimum to open

- $10 monthly service fee

- $0.10 for each check deposited

- $0.15 for each deposit

- $0.15 for each check presented for payment

- Earnings credit allowance on the average collected balance, less a 10 percent reserve requirement, offsets all or a portion of the monthly service fee and per item fees

Business Checking Benefits

- Free Online Banking, Mobile Banking, and Bill Pay

- Northway Debit Card available at no charge

- Check access

- 24-Hour Telephone Banking

Business Advantage

The Business Advantage checking account from Northway Bank is designed for businesses that anticipate higher transaction volume. Monthly fees are waived by maintaining a qualifying balance.

Contact your local branch or business banker.

Business Advantage Features

- $100 minimum to open

- $20 monthly service fee is waived by maintaining a qualifying balance*

- 300 items per statement cycle at no cost (items are defined as checks written and presented for payment, checks deposited and per deposit); $0.30 per item thereafter

*Qualifying balance defined as at least $15,000 in Business Advantage checking or at least $20,000 in a combination of checking, savings, money market accounts, and CDs. Must be maintained for each day of the statement cycle.

Business Advantage Benefits

- Free Online Banking, Mobile Banking, and Bill Pay

- Northway Debit Card available at no charge

- Check access

- 24-Hour Telephone Banking

Business Advantage Premier

Business Advantage Premier is a non-interest-bearing relationship account designed for mid-sized clients with larger balances and transaction volumes. The account rewards qualifying balances by waiving the monthly service charge.

Contact your local branch or business banker.

Business Advantage Premier Features

- $100 minimum to open

- $30 monthly service fee is waived by maintaining a qualifying balance*

- 500 items per statement cycle at no cost (items are defined as checks written and presented for payment, checks deposited and per deposit); $0.30 per item thereafter

*Qualifying balance defined as an average monthly collected balance of at least $50,000 in Business Advantage Premier or at least $50,000 in a combination of checking, savings, money market accounts, CDs, and commercial loan balances.

Business Advantage Premier Benefits

- Free Online Banking, Mobile Banking, and Bill Pay

- Northway Debit Card available at no charge

- Check access

- 24-Hour Telephone Banking

Business NOW

Northway Bank's Business NOW account is an interest-bearing account designed for sole proprietors and non-profit organizations.

Contact your local branch or business banker.

Business Now Features

- $100 minimum to open

- $1,500 minimum daily balance required to earn interest

- $5 monthly service fee will be waived by maintaining an average daily collected balance of at least $500

- Monthly service fee and all item charges waived by maintaining an average daily collected balance of at least $10,000

- 50 items per statement cycle at no cost (items are defined as checks written and presented for payment, checks deposited and per deposit); $0.05 for each check deposited and $0.15 for each check paid thereafter

Business Now Benefits

- Free Online Banking, Mobile Banking, and Bill Pay

- Northway Debit Card available at no charge

- Check access

- 24-Hour Telephone Banking

Compare Accounts

| Business Value | Business Checking | Business NOW | Business Advantage | Business Advantage Premier | Collateralized NOW (municipal only) | |

|---|---|---|---|---|---|---|

| Minimum Opening | $100 | $100 | $100 | $100 | $100 | $100 |

| Minimum Balance to Avoid Service Charge | N/A | N/A |

$500

(see details in link below)

|

$15,000 or

$20,000

combined

(see details in link below)

|

$50,000

combined

(see details in link below)

|

N/A |

| Monthly Service Charge | $0 | $10 | $5 | $20 | $30 | $0 |

| Free Items per Statement Cycle | 100 | 0 | 50 | 300 | 500 | N/A |

| Interest Bearing | No | No | Yes | No | No | No |

| Transaction Fee | $0.501 | Variable2 | Variable3 | $0.304 | $0.305 | N/A |

| Free Online and Mobile Banking | X | X | X | X | X | X |

| Free Debit Card | X | X | X | X | X | X |

| Free Bill Pay | X | X | X | X | X | X |

| More > | More > | More > | More > | More > | More > |

1100 items per statement cycle at no cost (items are defined as checks presented for payment, checks deposited, and per deposit); $0.50 per item thereafter.

2$0.10 for each check deposited, $.15 for each check written and presented for payment, and $0.15 for each deposit.

350 items per statement cycle at no cost (items are defined as checks presented for payment, checks deposited, and per deposit); thereafter $0.15 for each check paid and $.05 for each check deposited.

4300 items per statement cycle at no cost (items are defined as checks written and presented for payment, checks deposited and per deposit); $0.30 per item thereafter.

5500 items per statement cycle at no cost (items are defined as checks written and presented for payment, checks deposited and per deposit); $0.30 per item thereafter.

Reorder Checks and Supplies

When it's time to replenish your supply of Northway Bank business checks and supplies, you can place an order online in minutes with our partner, Deluxe.

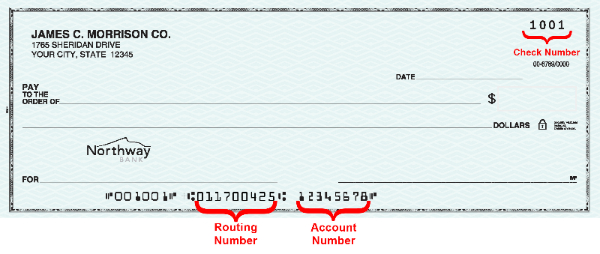

Northway Bank's routing number is 011700425. Your checking account number can be found in the following location on your check.

You can also order these other banking products: Deposit Tickets, Endorsement Stamps, Registers, Binders and more.

Locate Routing Number

Routing numbers are nine-digit identifiers unique to each financial institution. They are used in conjunction with account numbers to process banking transactions.

Northway Bank Routing Number: 011700425

The routing number can also be found on the bottom of your business checks.

Customer Service 800-442-6666

24-Hour Telephone Banking 888-568-6310

NMLS #405698