Our NEW Online and Mobile Banking platform is live! Please read the important information below as it may impact your Online and Mobile Banking experience.

***If you are a current mobile app user and you still have not updated to the NEW Mobile Banking app, we strongly recommend that you do so as soon as possible.***

After August 27th, you will not be able to login to the old Mobile Banking app. Users will continue to be prompted to update to the new app upon launch of the old app through September 10th, we encourage you not to wait! On September 11th, if you have not yet downloaded the new mobile app and you attempt to access via the old app, you will be prompted to contact us. The new app will need to be downloaded from your mobile device app store.

We will continue to post updates and share important information to make this transition as smooth and seamless as possible. Our Customer Service Center is expecting higher than normal call volume and longer wait times may be anticipated. If you have questions specific to your account, you can also use our 24-Hour Automated Telephone Banking at (888) 568-6310.

Important details…

- Enhanced Security – Two-Factor Authentication – Upon Initial Login, you will be prompted to select a preferred delivery method for a one-time-passcode that will be delivered to you outside of the system to verify your identity. Available options are text message, phone call, Authy (authenticator app), or a different authenticator app of your choosing.

- Linked Accounts - If you have accounts with other financial service providers that are linked to your Northway Bank deposit account (like PayPal, Venmo, or Zelle), you may be required to disconnect and reconnect your account(s) with those services due to the upgrade.

If you are a current Online Banking or Mobile Banking customer, there are a few things that will not change and have no effect on your current banking:

- Username and password - You can continue to login with the same credentials you use today.

- Scheduled payments - Scheduled Bill Pay payments and payees will carry over to the new platform.

- External transfer accounts - any verified external bank accounts that you currently have added under the Bank-To-Bank Transfer option will not require re-enrollment.

Other features...

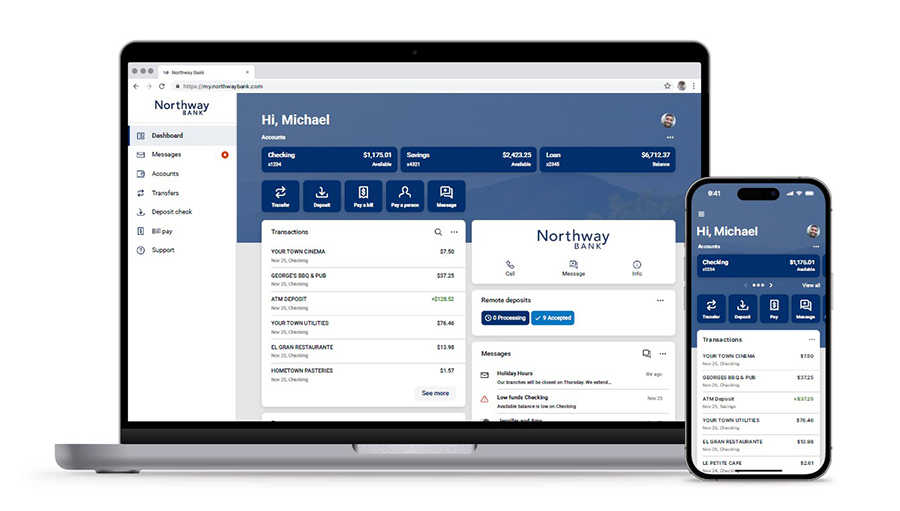

- A modern, consistent look and feel across all your devices - desktop or mobile - simplifying how you manage your accounts and move money.

- A more personalized experience - arrange your Dashboard in a way that makes the most sense to you.

- If you are a current app user, you will be prompted to download our new app, however there will be no change to your current username and password - you can continue to login with the same credentials you use today.

- Two-Factor Authentication - A code will be delivered to you outside of the system to verify your identity.

You’ll also be able to:

- Connect accounts at other participating financial institutions through the Mobile app.

- Add multiple Northway Bank user profiles - access multiple Online Banking profiles from any device.

- Add notes, tags or images such as receipts to your transactions.

FAQs

| Transaction history |

At first login, you will be able to view 90 days’ worth of transaction history. Over time, additional transaction history will populate. Enrolling in electronic statements will provide you with additional transaction history.

If transaction details are needed that exceed the 90-day timeframe, these details can be located on your account statement, by calling Northway Bank at (800) 442-6666, or by visiting your local branch.

|

| Alerts | Enabled alerts will need to be established in the new platform. Enabled alerts can be located under the Options tab in the current platform for your review. |

| Electronic Statements and Notices |

Documents

This tab will be utilized to view Electronic Statements and Notices, known today as “My eDocs”. If you are not yet enrolled in Electronic Statements, you will be prompted to do so prior to using this function. Electronic Statements

Utilize this option when you would like to make changes to your current account enrollment or update the email address associated with your eStatement delivery. Please note, if using Safari, you will need to disable 'cookie detection' to successfully access your statement.

|

| Supported Browsers |

Current or one of the prior two versions of the browsers below:

Latest version only:

|

| Bill Pay |

All scheduled Bill Pay payments, existing payees and payment history will be available in the new Online and Mobile Banking platform.

Please note, if using Safari, you will need to disable 'cookie detection' for Bill Pay single sign-on (SSO) to work.

|

| Transfers |

Internal Transfers - Scheduled transfers will copy over, except from a loan account or overdraft account

External Transfers - All verified external accounts (as of the day prior to go live) and scheduled recurring transfers will copy over.

|

Customer Service 800-442-6666

24-Hour Telephone Banking 888-568-6310

NMLS #405698